What is the Dollar Tree worker W-2 form? It is a tax document, that employers release to their employees each year. It shows important information about the income you’ve earned from your employer and taxes withheld for the year.

Sign-up is required to receive their W-2 forms electronically. So, register yourself at the paperless employee portal to access your employer’s services online.

If you have any queries regarding your paperless employee account, feel free to ask via email at myinfo@dollartree.com.

Information in W-2 Form

W-2 is a crucial document that outlines an employee’s earnings and tax withholdings. If you check your W2 form for the specific year you will find more things in this document such as:

- Employee information

- Employer information

- Wages (including social security, medicare, etc), and Salaries.

- Unified income tax withheld

- State and local taxes and other information.

Log in to DOCULIVERY SYSTEM to access W-2

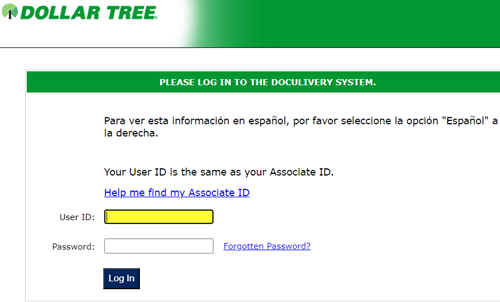

Your digital W2 paper is available in the external Dollar Tree Doculivery system. So, let’s log in here:

- Pages this URL https://my.doculivery.com/External/DollarTree/Login.aspx with an internet connection.

- Sign in using your User ID and Password.

- Now, go to the W2 Form option to access your W2 files.

Receive the W-2 Form at your Home Address

Want to receive the W-2 form at your mailing address, log in to your paperless employee account and check the mailing address to ensure the upcoming tax statement is received at the right address on time.

If you want to view and change the home address for the W-2 paper, visit http://www.paperlessemployee.com/Dollartree. If you need any assistance accessing this website, email your query to Myinfo@dollartree.com.

Importance of Dollar Tree Associates W-2 Form

Why W2 form is important for employees? It plays an important role in Dollar Tree associates, but how? Let me tell you:

Tax Filing

This document is key in filing federal and state income tax returns.

Social Security Benefits

Dollar Tree employees’ W-2 form is also used to receive social security benefits digitally.

Medicare Coverage

Employees use this document for Medicare coverage.

Proof of Income

It proves your income when applying for loans, renting an apartment, and other transactions.

Employment Verification

It can be used to verify your employment history and income.

Helpful Links

| Register and Sign-in for W-2 at | https://my.doculivery.com/DollarTree |

| View and change mailing address | http://www.paperlessemployee.com/Dollartree |

Conclusion

The W-2 form serves as an important document in DollarTree employees’ lives. It plays an important role when you file annual tax returns, as proof of annual income, and more. Dollar Tree provides this document in both online and offline ways.